LTC INSURANCE BENEFIT

Welcome to the Good Life

What is Long Term Care LTC?

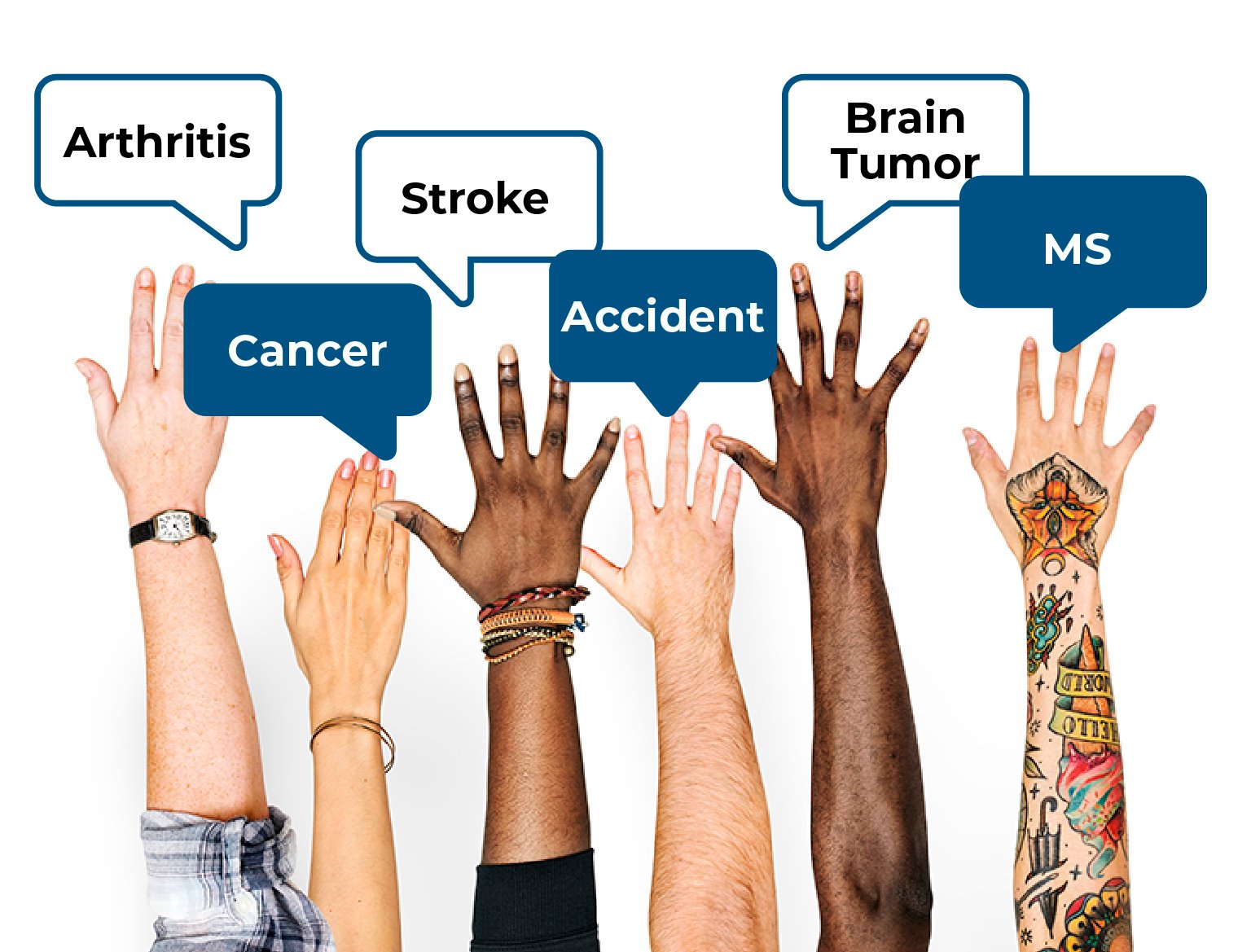

LTC is custodial care received in an assisted-living facility, nursing home or your own home should you end up with a physical impairment1 and need assistance with two out of six Activities of Daily Living (ADL's) and/or suffer from a severe cognitive impairment.2 Some reasons people need this type of care are injury (such as a car accident), illness (such as Cancer), aging or a cognitive impairment (such as Alzheimer’s disease, Dementia or effects of a stroke).

1A physical impairment is created by chronic medical conditions, defined as an illness that can be managed with therapy or medication but cannot be cured by either.

2A cognitive impairment is defined as a measurable decline in one’s intellect to the extent that the individual is also compromised.

What is my risk of Needing LTC?

2.3%

Risk of getting into an auto accident

12.5%

Risk of becoming disabled

40%

Risk of needing LTC

(ages 18-65)

67%

Risk of needing LTC

UNDERSTANDING THE DIFFERENT

Types of LTC Facilities

Home Care

$58,300 per year

Assisted Living

$54,700 per year

Nursing Home

$112,300 per year

Why Employers Offer LTC Insurance

| Product Accessibility | |

| Employer Rates | |

| Competitive Benefit | |

| Portable Coverage |